Are you thinking about investing money into your business? You could not have picked a better time!

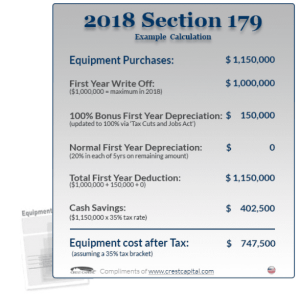

A recent change to the Section 179 Deduction, under the Tax Cuts and Jobs Act, has increased the amount of money that taxpayers are allowed to deduct to $1 million on their income taxes as an expense, rather than requiring the cost of the property to be capitalized and depreciated.

As of Jan. 1, 2018, the Tax Cuts and Jobs Act has expanded the definition of qualified property that is eligible for expensing under Section 179 Tax Deduction; this includes improvements to commercial roofing.

Section 179 Explained

It may seem daunting when you start looking into tax law, but Section 179 is not as complicated as it may seem. Section 179 of the IRS Tax Code allows a business to deduct, for the current tax year, the full purchase price of equipment and off-the-shelf software that qualifies for the deduction.

Simply put, the US government wants businesses to invest in themselves, so if you purchase something for your business that qualifies, you can deduct the full price of that business purchase on your taxes of that same calendar year.

What Qualifies?

The Section 179 Tax Deduction covers business supplies, upgrades, improvements, and property that is purchased or leased in the same calendar year. Since the deduction was created with all businesses in mind, the list includes purchases that many companies need.

The list of qualifying purchases includes, but is not limited to:

- Certain improvements to existing non-residential buildings: roofing, fire suppression, alarms and security systems, and HVAC.

- Equipment (machines, etc.) purchased for business use

- Business Vehicles with a gross vehicle weight more than 6,000

- Computers and “Off-the-Shelf” Software

- Office Furniture and Equipment

- Property attached to your building that is not a structural component of the building (e., a printing press, large manufacturing tools, and equipment)

Limitations

There are a few limitations to consider with the Section 179 tax deduction:

- Dollar Amount – The dollar limitation has changed over the years, but after the most recent update (as of May 2018) the dollar limit is $1 million.

- To qualify for the Section 179 deduction for any given tax year, the equipment must be purchased (or financed/leased) and placed into service between January 1 and December 31 of that year.

- If a taxpayer places more than $2 million worth of Section 179 property into service during a single taxable year, the Section 179 deduction is reduced, by the amount exceeding the threshold.

- The amount allowed as a deduction can’t exceed the aggregate amount of taxable income for the business during that year.

Using Section 179 for Commercial Roofing

While Section 179 covers many purchases and investments in businesses, we are excited to highlight that you can use the newly updated tax deduction for roofing improvements to non-residential facilities. These improvements include roofing repairs, waterproofing and even full reroof projects on existing buildings.

Read More from The National Roofing Contractors Association

This proves to be an excellent opportunity to take advantage of the all-time high Section 179 tax deduction to solve problems with your roof that have been plaguing your facility.

You can solve your leaking roof problems and be able to write off your contractor bill as a tax deduction …what could be better than that?

If you have been considering some work on your roof system, contact us today to take advantage of this tax deduction!

At West Roofing Systems, we take pride in the new roofs we install and the maintenance we provide for our customers and their commercial, industrial and manufacturing buildings. Our M.a.R.S. (Maintenance and Repair Service) Program is available for new and existing roof systems.

Choosing West Roofing Systems as a turnkey roofing company will provide you with highly trained teams and award-winning service. Our services are flexible and diverse; we can recoat, repair or replace your facility’s roof so that it lasts decades.

Read More:

- Brown Spots on Your Ceiling? Causes & Solutions for Water Stains

- How Much Will a Commercial Roof Cost?

- C.ommercial Roofing Installation and Costs: SPF vs. Single-Ply vs Metal Roofing

Original Post Here: Section 179 Tax Deduction for Commercial Buildings

No comments:

Post a Comment